Why the Market Crash is Just Beginning

October 29, 2018

Wall Street’s playbook stipulates that every down tick in the market is just another buying opportunity. While that is most often true, peak margins, a slowing global economy and the bond bubble collapse makes this time more like 2008 than just a routine selloff.

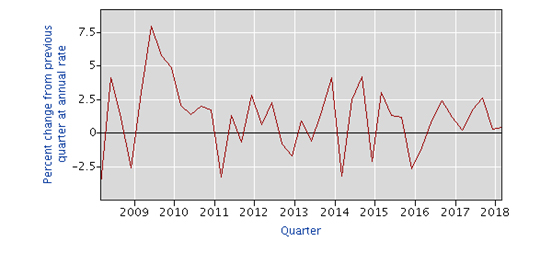

In the vanguard of this coming market crash is China, whose make-pretend growth rate slid to 6.5% in the third quarter. This is the slowest pace of growth that the communist government has been willing to own up to since the last global financial crisis. Leaving one to conclude that the reality in China is far worse.

This sluggish growth and a near 30% plunge in Shanghai shares prompted swift action from the Chinese government, which announced plans to cut personal income taxes and cut the Reserve Requirement Ratio for the fourth time to encourage more leverage on top of the debt-disabled economy. The government has even bought ETF’s to prop of the sinking Chinese stock market. As a result, shares recently surged 4% in one day. However, more than half of those gains were quickly reversed the following day as investors took a sober look at whether the Chinese government is starting to lose its grip on the economy.

This sluggish growth and a near 30% plunge in Shanghai shares prompted swift action from the Chinese government, which announced plans to cut personal income taxes and cut the Reserve Requirement Ratio for the fourth time to encourage more leverage on top of the debt-disabled economy. The government has even bought ETF’s to prop of the sinking Chinese stock market. As a result, shares recently surged 4% in one day. However, more than half of those gains were quickly reversed the following day as investors took a sober look at whether the Chinese government is starting to lose its grip on the economy.

According to the Wall Street Journal, investments in Chinese factories and other fixed assets are at their lowest level in 18 years and China’s usually reliable household consumption is also beginning to decelerate sharply.

China’s economy has been on a downward trajectory in the past few months, with auto and retail sales on the decline. Fixed-asset investment rose a mere 5.3% in the January-August period from a year earlier. It was the most lackluster growth rate since 1992. This was mostly a planned slowdown; an edict from the government that realized its economy was beginning to resemble a Ponzi scheme.

What is very interesting is that this lethargic growth persisted even though companies have been gearing up for U.S. tariffs on Chinese products; hence, front-running purchases. Macquarie Capital Ltd. predicts that Chinese growth from exports will decline as much as 10% in the coming months.

All this concern about decelerating growth is hindering China’s deleveraging plans that it promised to follow through on at the beginning of this year. According to the Financial Times, Chinese debt was in the range of 170% of Gross Domestic Product prior to the Great Recession. But in 2008, China responded to the financial crisis with a huge infrastructure program—building empty cities to the tune of 12.5% of GDP, the biggest ever peacetime stimulus.

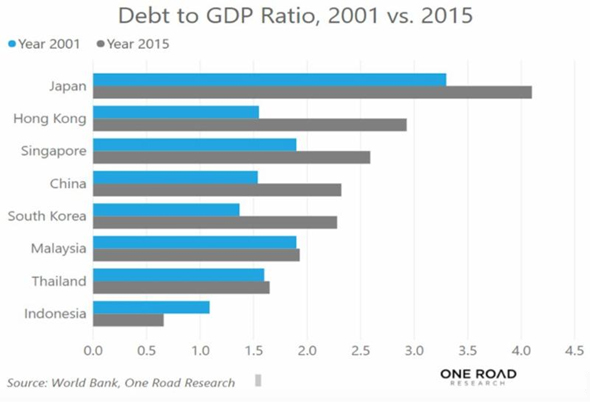

According to the Institute for International Finance, China’s gross debt has now exploded to over 300% of GDP. Bloomberg estimates the dollar amount of this debt—both public and private–at $34 trillion; others have it as high as $40 trillion. With a gigantic shadow banking system, this number is obfuscated by design.

Adding to the problem is that much of the Chinese private debt is pledged with collateral from the stock market, which has been in free-fall this year. According to Reuters, more than 637 billion shares valued at $4.44 trillion yuan ($639.86 billion) were pledged for loans as of Oct. 12. As the air continues to pour out of the stock market, it will put additional pressure on the debt market.

Most importantly, China’s debt binge was taken up in record time; soaring by over 2,000% in the past 18 years. And this earth shattering debt spree wasn’t used to generate productive assets. Rather, it was the non-productive, state-directed variety, which now requires a constant stream of new debt to pay off the maturing debt. Therefore, the schizophrenic communist party is caught between the absolute need to deleverage the economy; and at the same time, trying to maintain the growth mirage with additional stimulus measures.

The stimulus provided thus far has managed to expand the amount of money in circulation, M2—a measure of the money supply that includes cash and most deposits—to 8.5% this year, from 8.1% last year. Yet, even with a large growth in the money supply, China has not been able to achieve its desired rate of growth because it is weighed down by its legacy of debt.

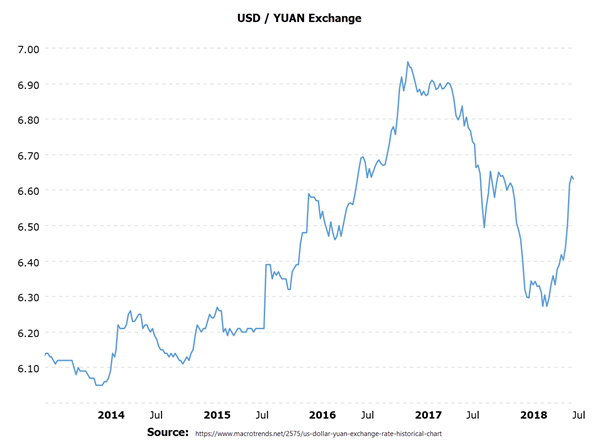

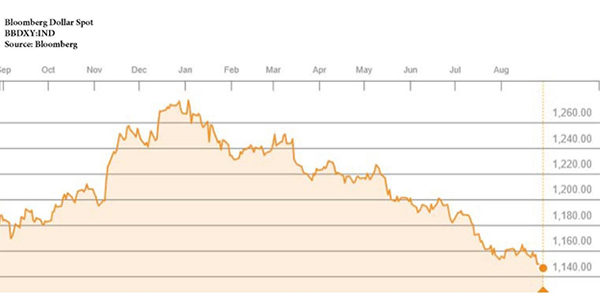

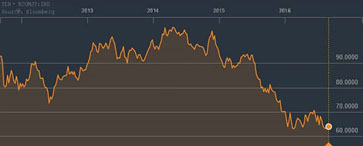

Although this latest round of fiscal and monetary stimulus has not had the anticipated economic effect to date, it has produced a negative effect on the Chinese yuan. Leaving some to wonder if China is finally losing control over its currency. In August 2015, an unexpected devaluation in the yuan led to a capital flight as Chinese companies, citizens and investors sought to protect themselves from further declines in the currency. If the yuan weakens too quickly again—either naturally or by another planned devaluation—this would add even more chaos to the already fragile global markets.

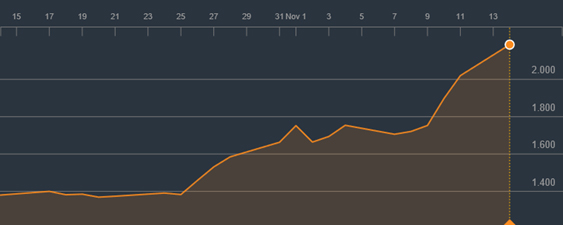

The yuan has fallen nearly 10% against the dollar since April ‘18. The Chinese are currently trying to keep the currency from falling below the key support level of seven to the dollar. The yuan hasn’t traded that low in more than a decade; but holding that line has become more difficult as China dances capriciously from deleveraging to massive stimulus measures. In order to defend the value of the Yuan, China has depleted much of its dollar reserves.

The yuan has fallen nearly 10% against the dollar since April ‘18. The Chinese are currently trying to keep the currency from falling below the key support level of seven to the dollar. The yuan hasn’t traded that low in more than a decade; but holding that line has become more difficult as China dances capriciously from deleveraging to massive stimulus measures. In order to defend the value of the Yuan, China has depleted much of its dollar reserves.

A further yuan de-valuation could panic the Asian block nations in a similar way as did the Thai baht back in 1998; Leading to mass devaluations and putting further downward pressure on emerging markets.

But China isn’t the only wild card in the global growth deck of cards. Over in the Eurozone, Italy is brazenly threatening to move forward with a budget proposal that would obscenely breach the European Union’s budget guidelines. The bureaucrats in Brussels are threatening fines. But this doesn’t appear to be enough to inhibit the Italian government, which is intent on increasing social welfare programs, adding to pensions and giving workers a tax cut.

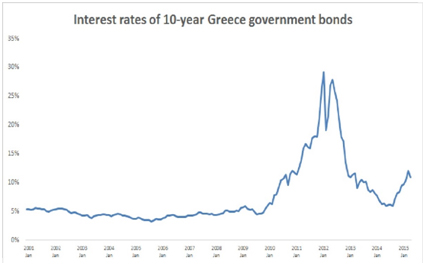

These bold plans have led the rating agency Moody’s to downgrade Italy’s sovereign debt to one notch above junk. Uncertainty in Italy is a major geopolitical factor weighing on global sentiment. Investors are rightly concerned about the Rome-Brussels stand-off, given that Italy is the Eurozone’s third-largest economy and its debt is held by every major bank in Europe—and most in the U.S. As interest rates rise in Italy, the prospect of insolvency rises alongside.

Bond Bubble Conundrum

October 22, 2018

Wall Street shills are in near perfect agreement that the bond market is not in a bubble. And, even if there are a few on the fringes who will admit that one does exist, they claim it will burst harmlessly because the Fed is merely gradually letting the air out from inside. However, the fact that we are in a bond bubble is beyond a doubt—and given the magnitude of the yield distortions that exist today, the effects of its unwinding will be epoch.

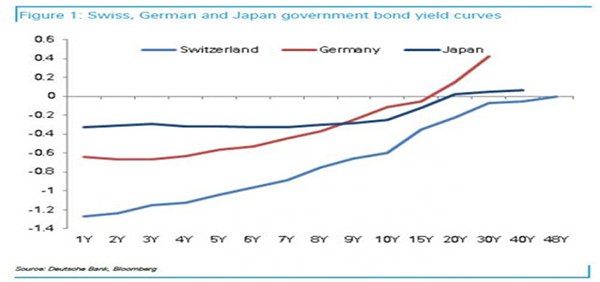

Due to the risks associated with inflation and solvency concerns, it should be a prima facie case that sovereign bond yields should never venture anywhere near zero percent—and in some cases, shockingly, below zero percent. Even if a nation were to have an annual budget surplus with no inflation, it should still provide investors with a real, after-tax return on government debt. But in the context of today’s inflation-seeking and debt-disabled governments, negative nominal interest rates are equivalent to investment heresy.

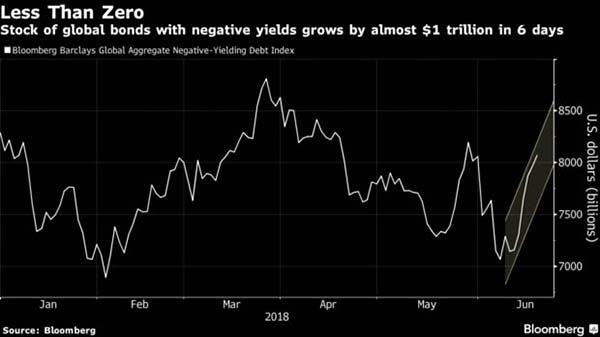

At its peak in 2016, there was a total of over $14 trillion worth of global sovereign bonds with a negative yield—mostly in European and Japanese debt. And even though that total has decreased recently, it is still above $8 trillion.

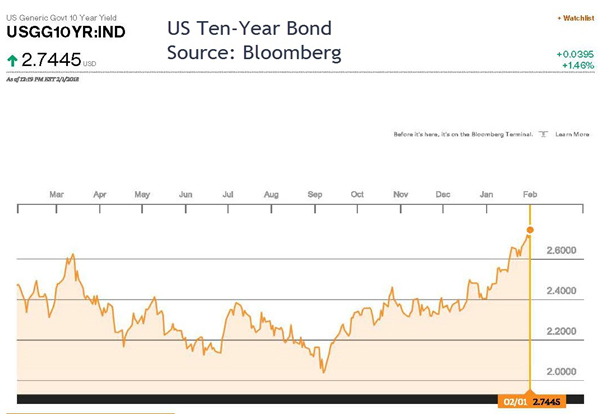

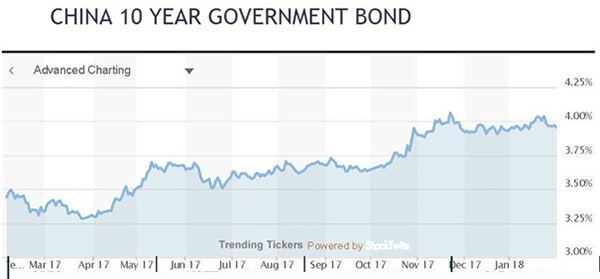

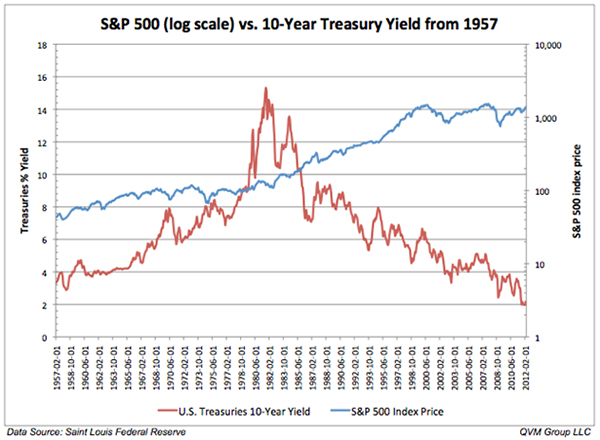

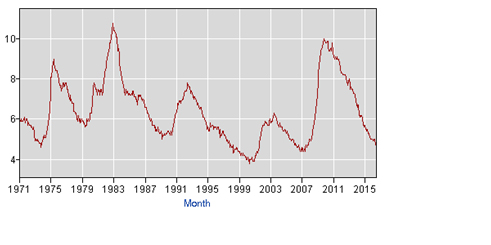

And although the U.S. Ten-year Treasury note yield has never been negative in nominal terms, it is still clearly in the sub-basement of history

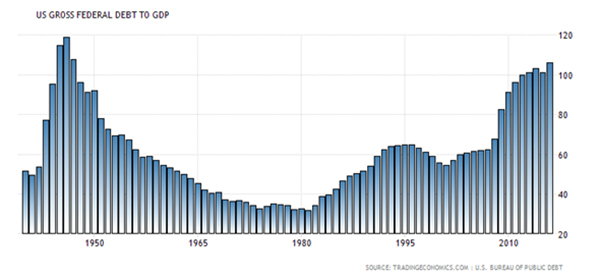

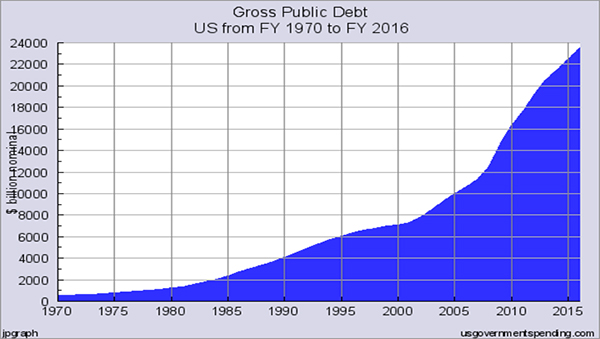

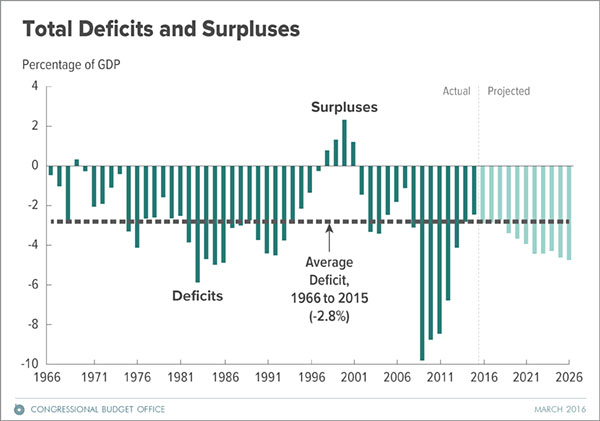

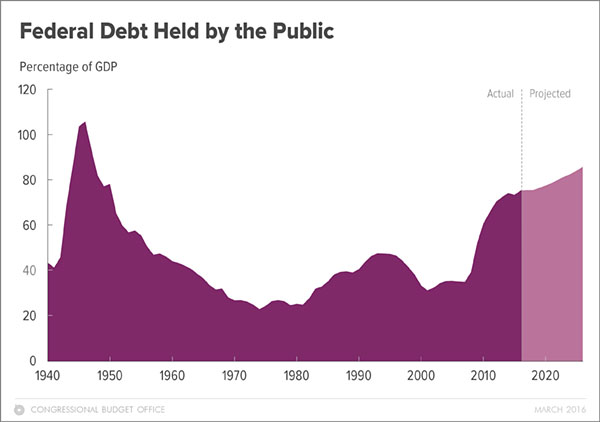

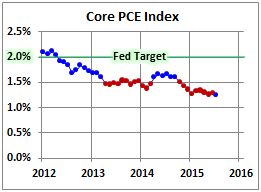

Given these facts, any free-thinking individual must assent that the global bond market is in a bubble. This situation may be definitely worse overseas, but the U.S. bond market still suffers from the same contagion. Given our trillion dollar annual deficits, a national debt that is $21.5 trillion (105% of GDP), and consumer price inflation that is above the Fed’s 2% target, the abnormality in U.S. rates is completely absurd.

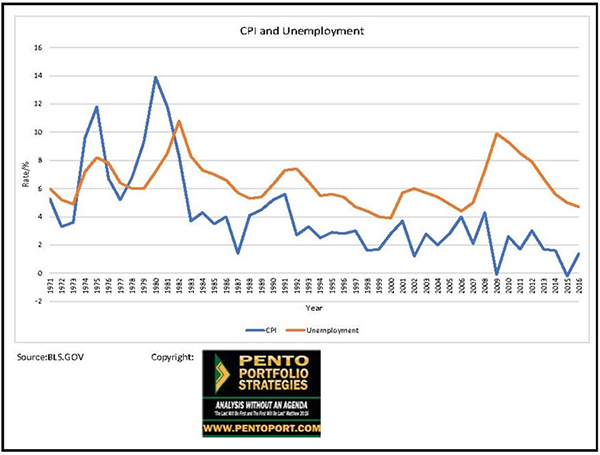

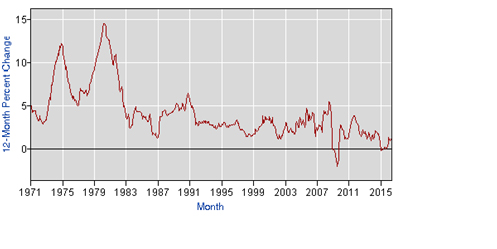

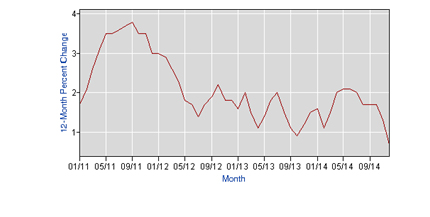

The key to this whole discussion about bonds being extraordinarily overvalued is the arrival of inflation on to the scene, which had been absent for a decade in the eyes of the consumer because it was mostly sequestered within stock, bond and real estate prices.

But because of central banks’ inflation “successes,” along with the additional $70 trillion worth of debt levels worldwide since the Great Recession, interest rates have recently started to rise. This has compelled many central banks to shift strategies from the pursuit of inflation, to one of inflation containment.

Importantly, this change from central banks is not a voluntary decision, unlike what the Wall Street carnival barkers would have you believe. In other words, rates are not rising for all the right reasons. But instead, they are rising due to runaway asset prices, surging debt levels and the resurgence of rising consumer prices. Therefore, these money printers have no choice but to retreat from their inflation quest, or they now risk a rapid and destructive rise in long-term bond yields.

Hence, global central banks are trying to stick the inflation landing by hoping CPI stays near the 2% percent level and praying interest rates nestle into a tight trading range that remains completely harmless to this overleveraged economy.

However, this is diametrically opposed to the very nature and construction of asset bubbles. Think about the last two examples of the NASDAQ crash in 2000 and the Real Estate debacle in 2008. These asset bubbles—just like all the others in history–needed a constant supply of new monetary fuel to stay inflated. The Fed inverted the yield curve shortly before each crash and cut off banks’ profit motive to lend. Not only this, but these assets became so inflated relative to incomes and the underlying economy that investors were no longer capable of throwing new money at them.

Once stock and home prices began to roll over, there was a panicked rush for the exits. This is primarily due to the massive leverage involved with these bubbles. Owning assets on margin and with excessive debt is very expensive and only makes sense in a raging bull market. As soon as the tide turns, the offers begin to pile up quickly and exacerbate the move lower in prices.

The bigger the distortion of asset prices the greater the reset will be. And the warping of interest rates courtesy of global central banks has never been anywhere near this extraordinary. What Mr. Powell, and the rest of the central bank leaders fail to grasp, is that asset bubbles contain tremendous potential energy and are virtually impossible to unwind innocuously.

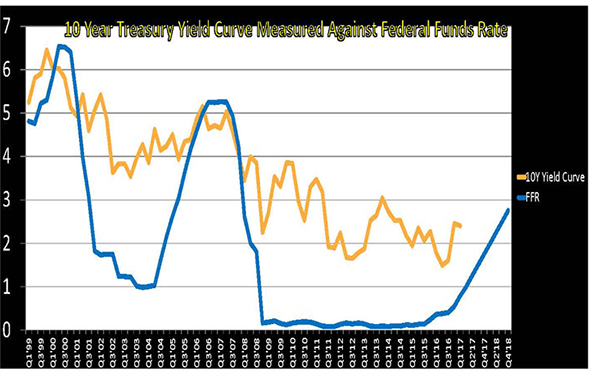

The Fed is trying to engineer a soft landing for the bond bubble it created, but no such condition is at all probable. If the Fed Funds Rate (FFR) was already close to its mean of around 6.5%, then perhaps this would be a possibility. However, at the current FFR of just 2.25%, it is far below the average and nowhere near the so-called equilibrium rate–where it is neither a stimulant or depressant for the economy—especially in light of the fact that no such condition of interest rate nirvana can ever be supplied by a central bank.

Therefore, herein lies the rub: if the Fed were to stop raising the FFR at the current level, there is a significant risk that long-term interest rates would explode higher on the back of surging debt levels and rising inflation. That would cause debt service payments to skyrocket and lead to mass insolvencies for consumers and corporations; just as it put extreme fiscal pressure on all levels of government. And, if the Fed were to continue on its path towards interest rate and balance sheet normalization, short-term rates will rise, and the credit-fuel supporting asset bubbles will get slammed shut. Thus, forcing the economy into a steep recession/depression from which there will be no easy escape.

History conclusively dictates that asset bubbles never correct with impunity; they leave a wake of carnage behind them commensurate with the extent of the previous imbalances. The worldwide and unprecedented bond bubble will certainly not be the exception to this empirical fact.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Inflation Target Regrets

October 8th, 2018

Beginning this fall, and continuing throughout 2019, the stock market’s performance should be vastly different from what has occurred during the prior few years. Indeed, the huge reconciliation of stock prices is arriving now.

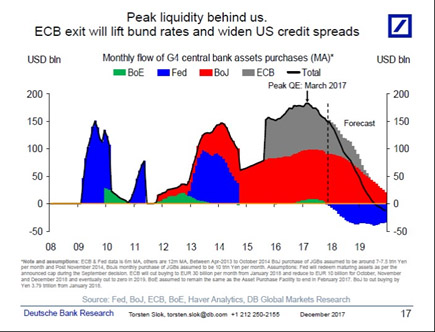

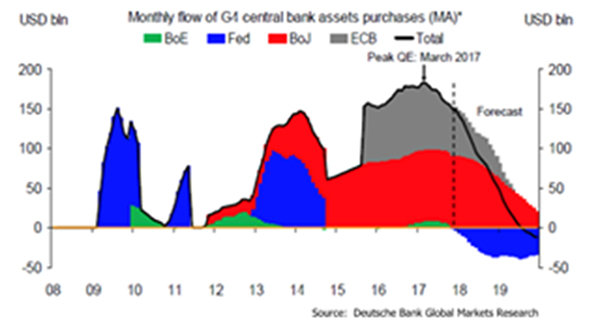

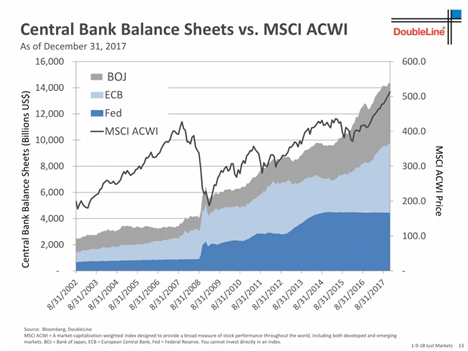

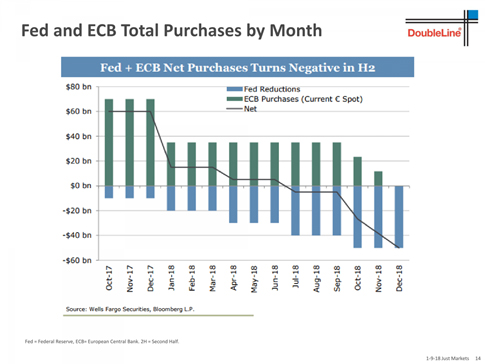

The primary reason behind this is the watershed change in global central banks’ monetary policies. For years central banks had been keeping rates near 0%, or below, and at the same time printing over a hundred billion dollars’ worth of fiat currencies each and every month to purchase bonds and stocks. That is all changing now. According to Capital Economics, fourteen major global central banks are either in the process right now, or have indicated that they be will next year, in the process of raising interest rates. At the same time, QE on a global net basis will plunge from $180 billion per month at its peak during 2017, to $0 by December…and will then go negative in 2019.

The amount of corporate stock buybacks will plunge next year as well. Estimates of between $500 billion to $1 trillion of stock buybacks have occurred so far due to the one-time mandatory repatriation of foreign earnings found in Trump’s tax cut package passed in December of 2017. However, that one-time boost from repatriation is waning quickly. In addition, there are now much higher borrowing costs for corporations that have relied on the process of issuing debt to buy back shares. This will only get more expensive next year and will also attenuate the number of corporate buybacks.

The benefits corporations enjoyed from lower taxes this year are being gradually offset by rising debt service payments and tariffs. This pressure on these fronts will also increase greatly next year.

There will most assuredly be a plunge in earnings growth rates from the current 25% pace, to the low single digits at best when Q1 ’19 gets compared to Q1 of this year. When you combine that surge in borrowing costs with; the stronger dollar, tariffs from the trade war, oil price spike, rising wages, the slowdown in China, the chaos in EM currencies–along with the significant bond market and equity market volatility around the world–you can clearly understand why S&P 500 companies will endure much greater pressure on earnings next year. And, given the fact that these corporations generate nearly half of their revenues in from foreign markets, don’t expect their share prices to be immune.

But emerging markets are not the only nations that are in turmoil. Recently, the Italian stock market plunged 4% and bank stocks were halted, as the Italian 10 year Note yield surged 32 bps. That yield has gone from 1% in 2016, to 3.60% today. Bond yields are surging in Italy right now, while the ECB cut its bond purchases in half again to €15T this month–and is scheduled to end QE by the end of December. Therefore, the Italian bond market is going to have to exist on its own next year along with the faltering Italian economy. Spiking interest rates are serving to increase deficits even further, which in turn sends rates yet higher.

Italian debt is now rated just two notches above junk. But a downgrade from any of 3 credit rating agencies should cause another huge spike in borrowing costs. This could force the ECB to back away from its hawkish stance—but it will be too little too late–and the euro should be sent crashing against the USD. If Mario Draghi does not return to QE, but rather allows the Italian bond market to continue to collapse, the entire European banking system is at risk of failure in 2019. Of course, this would imperil the global banking system as well. Perhaps this is one of the reasons why U.S. banking shares have not appreciated this year.

In fact, when you turn off the cheerleaders on CNBC and actually look closer at the data in the U.S., you will find that the distress found throughout the globe is already effecting the domestic economy. Pending home sales fell 1.8% for August, according to the National Association of Realtors’ seasonally adjusted index. Sales were down 2.3% compared with August 2017. That was the fourth monthly decline in the past five months and was the slowest sales pace since January.

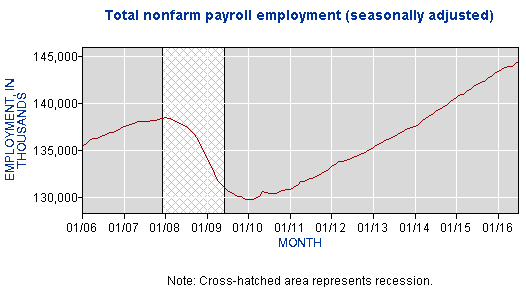

Turning to autos: Ford, Toyota, Nissan and Honda reported y/y monthly sales declines in September of 11.2%, 10.4%, 12.2% and 7%, respectively. So, despite upbeat employment data, two of the most significant parts of the US economy are in outright contraction mode.

In other words, the notion that central banks saved the world by counterfeiting $14 trillion worth of new credit and by pushing interest rates to 0% and below for a decade is absurdly ridiculous. Rather, what they did end up creating was unprecedented and massive imbalances in the global economy, along with a humongous bubble in asset prices that exist worldwide. From which there is no escaping without devastating consequences.

This long awaited day of reckoning has been held in abeyance until now. However, the incredibly stupid and dangerous goal of governments to create a sustainable rate of inflation throughout the world has now been achieved. Inflation was masked for years by remaining sequestered in asset prices alone. But now it has spread to consumer prices and wages. Therefore, central banks have no choice but to react ex-post to keep inflation from transcending their fatuous and dangerous targets.

But, what they cannot fully understand it that there is a record $250 trillion of global debt that was issued in order to push up asset prices to unchartered valuations. And those asset price bubbles are completely dependent upon never-ending and ever-increasing central bank and government stimuli to remain in a bubble; or the entire artificial construct comes crashing down.

However, the inflation pump has been turned off this year and will go into reverse throughout next year. This change is not so much by choice but due to asset price levels and inflation rates that are at risk of becoming intractable if central banks did not act.

That is the trenchant difference from the past few years. It is going to be extremely painful for investors that are unprepared for this incredible change. It has become essential to model these changes that are now occurring in the growth and inflation dynamic. The Pento Portfolio Strategies’ proprietary Inflation/Deflation and Economic Cycle Model SM indicates there should soon be an opportunity to profit from the coming deflationary crash in markets; and then the strategy would be to pick up the pieces in the middle of the carnage to ride the next wave of inflation higher.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Global Central Banks Enter the Danger Zone

October 1st, 2018

Investors are experiencing huge moves in commodities, currencies, equities and in sovereign debt across the globe. And now the fall has arrived. Expect the volatility currently witnessed in markets to only surge.

This is because global central banks have overwhelmingly turned hawkish in a vain attempt to gradually let the air out of the massive bubbles they have spent the last decade recreating. Unfortunately, that is not the nature of asset bubbles—they don’t end with a whimper–and they are about to burst in violent fashion.

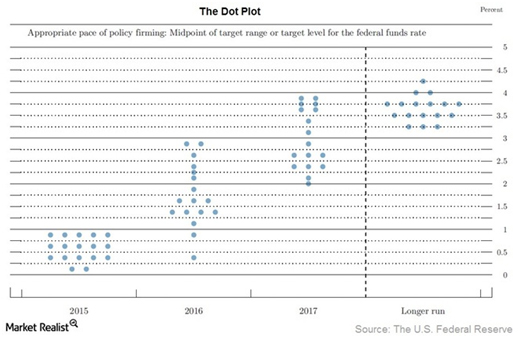

First off, our central bank hiked rates for the 8th time since December 2015 at the September FOMC meeting. While the Fed did remove the word accommodative from its policy statement, it also raised the neutral rate to 3%, from 2.9% on the Fed Funds Rate. And, most importantly, predicted it would stay above that neutral rate for two years—keeping it at the 3.4% level. It also indicated that December would be the next rate hike and that three more hikes are on the agenda for 2019.

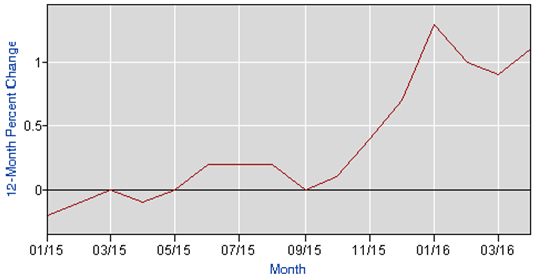

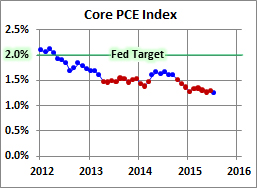

Nevertheless, the Fed is now caught in a hydraulic press of its own making; and is completely unaware of the predicament it is in. An inflation rate of 2% has been its goal for the past decade. And now inflation, when measured by core CPI, is up 2.2% y/y and is up 2.7% y/y on the headline rate. Even though the Fed emphasizes the Personal Consumption Expenditure inflation rate rather than Consumer Price Inflation, it is still aware that inflation is rising above its target.

Therefore, its own inflation models—however irrelevant and useless they may be—are compelling the Fed to keep on raising rates. But because inflation is a lagging indicator, the Fed will keep on hiking rates until the next economic downturn is well underway. However, since asset bubbles and debt levels have never been more disconnected from reality, the next economic downturn should quickly morph into a depression rather than just a normal recession.

The sad truth is that the global economy has become so unstable due to a humongous level of debt (up over 40% since 2008) that there is no R*, or neutral rate for the Fed to reach. One of the fatuous goals of central banks is to place interest rates at a level that is neither stimulative to inflation or a depressant to job growth—the real interest rate where the economy is at an equilibrium. The only problem with this exercise is that the Fed has no idea what level this R* rate should be. Only a free-floating and market-based interest rate can accomplish this task. For a central bank to usurp this process is both futile and dangerous.

But the Fed has already hiked to the point in which the global economy has started to falter. The discrepancy between U.S. interest rates and those of foreign markets has put upward pressure on the dollar and is putting debt service payments on the $11 trillion of dollar-based foreign loans under extreme pressure.

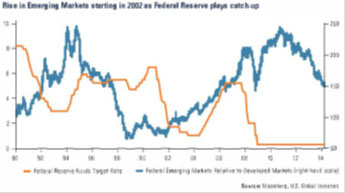

The current chaos in Emerging Markets would have started years ago if it were not for the Bank of Japan and the European Central bank’s massive ventures into money printing. The Fed’s ending of QE back in October of 2014 was merely offset by those other central banks’ purchases. Thus, delaying the deflationary impact of reverse QE.

However, the pace of global QE is crashing from a peak of $180 billion per month during 2017, to $0 by the end of this year. Also, 14 of the most important global central banks are in a rate hiking mode, while only 5 currently hold a dovish monetary policy stance. This means the gargantuan pile of $250 trillion worth of global debt, which is up $70 trillion since 2007, along with the surging level of annual deficits, to a great degree must now stand on its own. In other words, the private sector must step in to supplant government purchases or interest rates will simply skyrocket.

The amount of Publicly Traded Debt in the U.S. at the start of the Great Recession in December 2007 was $5.1 trillion dollars; and the Fed’s balance sheet totaled around $800 billion. That amount of Treasury issuance has now surged to $15.8 trillion today (not counting intra-governmental debt). And yet, the Fed’s balance sheet now totals $4.2 trillion. Therefore, that $4.2 trillion worth of Fed assets—an increase of $3.4 trillion–is trying to support nearly $16 trillion of publicly traded debt–an increase of 10.7 trillion!

Not only this, but the fed is no longer buying any of our deficits, which have surged 33% y/y. And in fiscal 2019 (starting this October) will total well over $1 trillion per year. Indeed, rather than buying all of the annual deficits, as it did during the QE periods, the Fed is adding to the deficit by selling $600 billion of debt per year as part of its reverse QE process. When you add $50 billion per month of QT to the four rates hikes per annum you end up with an extremely hawkish Federal Reserve.

Meanwhile, central banks will keep on hiking rates until asset prices and economic growth come crashing down around the globe. The truth is the global economy has become one giant central bank shell game; consisting of perpetually rising asset prices that have been supported by consistently falling interest rates. Interest rates that hover around zero percent have become mandatory to support surging debt loads. Now that QE is ending and interest rates are rising, the whole artificial construct has started to implode.

It is now very likely that the NYSE will suffer through one or more of what is known as circuit breaker days. The NYSE rule 80B, stipulates that there will be a 15 minute pause if the market falls by 7%. It will then reopen until the market drops by a total of 13%; in that case it will shut down for another 15 minutes. And then, if the market drops by a total of 20% intraday, it will close for the remainder of that day.

With trillions of investment dollars being moved from the active management style of investing to the passive and indexed ETF variety over the past few years, there is virtually nothing to offset the avalanche of sell orders and plunging stock prices once the panic begins. Time is running out to garner an active strategy that hedges your investments and seeks to protect your wealth from the coming deflationary wipeout.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Lessons from Lehman 10 Years After Failing

September 24th, 2018

Global financial services firm Lehman Brother’s stock was in free-fall during the first week of September 2008. After making huge bets in the mortgage securities space, Lehman’s President Dick Fuld feared bankruptcy and frantically sought out a buyer. The company was hopeful to strike a weekend deal with either Barclays PLC or Bank of America.

Nevertheless, Lehman’s outsized investments in the mortgage market ultimately proved them too risky a partner for anyone; and the giant investment bank went belly-up on September 15th. Prior to this event, Lehman had reported record earnings every year from 2005 to 2007. The Street believed the company to be infallible. Analysts held on to hope until the bitter end. Their mantra went something like this, “nothing to see here, this is a small correction in a small section of the housing market that has little effect on the overall economy.”

But it wasn’t the first time that year that analysts got it wrong. The Wall Street perma-bulls also missed the eleventh-hour fire sale of Bear Sterns to JP Morgan for $2 a share. Five days before the sale, a CNBC host who loves to play with buttons fervently advised a viewer to leave his money in the firm, insisting it would be silly to make a sale at current values. However, less than a week later it lost $60 per share!

The Lehman case became the largest bankruptcy filing in history, surpassing other bankrupt giants such as WorldCom and Enron. Markets were panicked. The following day, September 16th, AIG called then-Fed Chairman Ben Bernanke asking for an $85 billion dollar bailout. For years AIG had collected premiums on Credit Default Swaps (CDS), which are basically insurance policies on debt. All three credit rating agencies, which had rubber stamped all new debt issuances as AAA for years, finally downgraded AIG to AA-, immediately triggering a collateral call of $32 billion dollars. In just one day AIG was basically insolvent. AIG had written CDS contracts on $500 billion in assets, $78 billion of these were on residential and commercial mortgages and home equity loans. Remember, the same types of loans Wall Street and the Fed assured investors were rock solid.

And this was Tuesday; the week had just begun…

September of 2008 was perhaps the most eventful month in Wall Street’s history. On September 21st Goldman Sachs and Morgan Stanley, the last two independent investment banks, become bank holding companies, so they could compete for deposits with commercial banks and better ensure their solvency.

On September 25th a group of Washington Mutual Bank executives boarded a plane to Seattle. Upon de-boarded, they discovered that the Fed had seized their bank assets and sold them to JPMorgan Chase; marking it the biggest U.S. bank failure in history.

And then, of course, Congress got in on the fun rejecting a $700 billion Wall Street financial rescue package known as the Troubled Asset Relief Program, or TARP, on September 29th ; before accepting it on October 3rd.

Also occurring in that infamous month of September 2008 was the placing into conservatorship of both Fannie Mae and Freddie Mac; those two giant government sponsored enterprises that would have gone bankrupt without a taxpayer bailout.

The problems didn’t end with September. October saw Wells Fargo, the biggest U.S. bank on the West Coast, squeeze out Citi Group to buy floundering Wachovia for about $14.8 billion dollars. And it was a good thing Citi wasn’t successful in their acquisition because in November the Treasury Department, Federal Reserve, and Federal Deposit Insurance Corp., all had to come up with a plan to rescue Citigroup. Citi issued preferred shares to the Treasury and FDIC in exchange for protection against losses on $306 billion of securities it held.

When the dust settled, the government exited the mergers and acquisitions business and did what it does best–namely, create a scheme to monetize debt and re-inflate asset prices. The first round of Quantitative Easing–a form of government-sponsored counterfeiting–was announced on November 25, 2008.

It’s important to remember that while this major crisis was brewing the Fed saw nothing on the horizon. Then Fed Chair Ben Bernanke saw no bubbles or risk for the broader economy, even as subprime mortgages started to collapse. Janet Yellen, Bernanke’s successor as Fed Chair, made this infamous quote regarding the real estate sector in September 2006, “Of course, housing is a relatively small sector of the economy, and its decline should be self-correcting.”

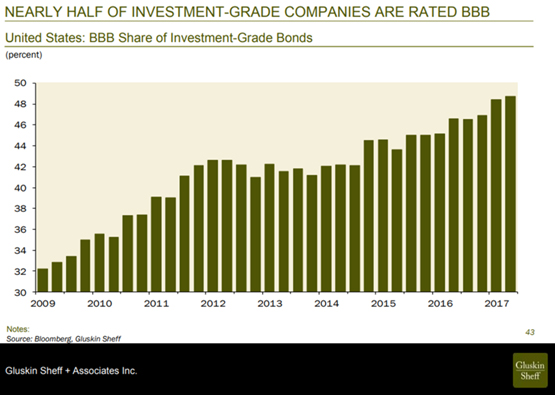

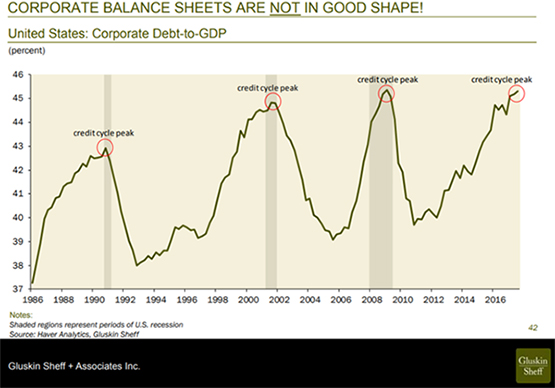

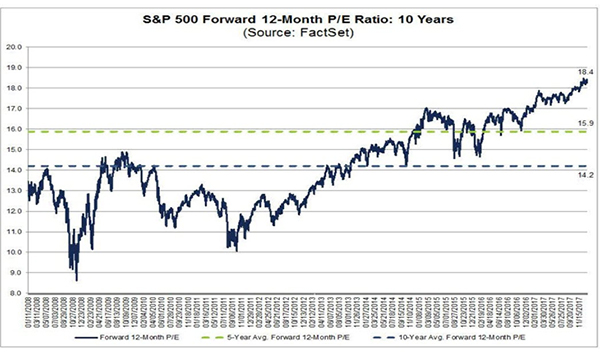

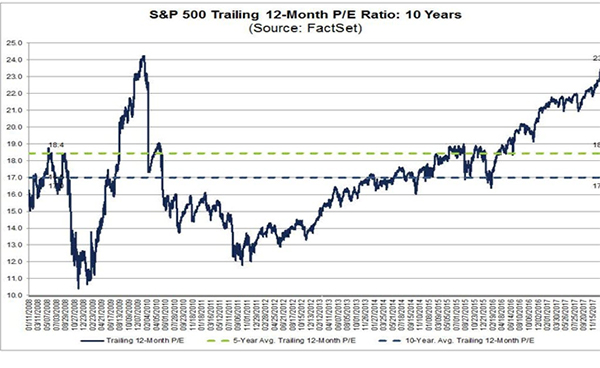

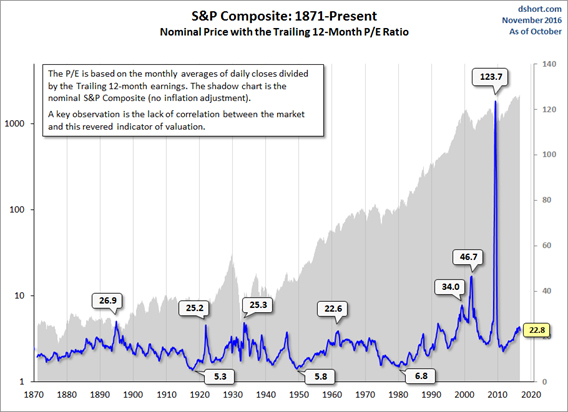

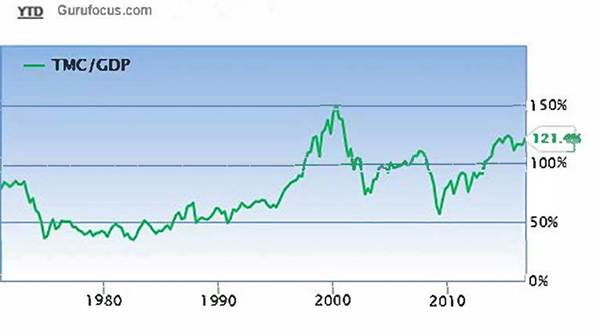

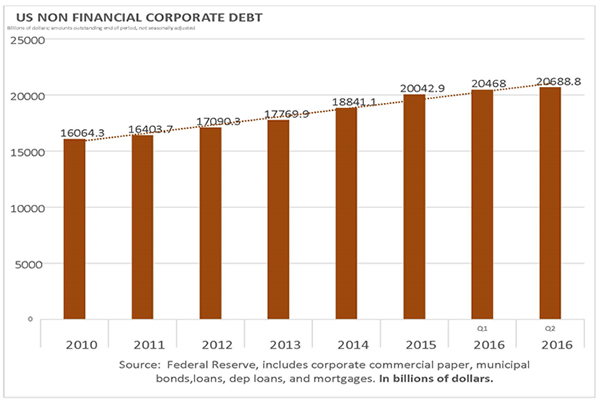

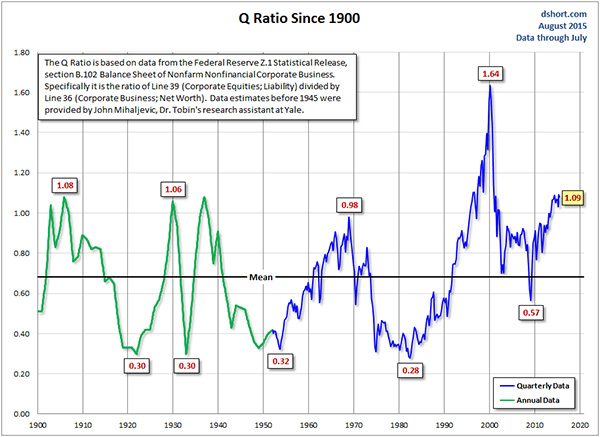

Fast forward to today, Wall Street and the Fed are busy assuring us there are no bubbles out there at all. And, even if one does exists, it poses no threat to the overall economy whatsoever. They want you to ignore the doubing of the National Debt since Lehman failed. Don’t worry about an annual deficit of $1 trillion either; which is projected to only surge “big league” from its current level of over 5% of GDP. Never mind stock prices that are 1.5x the underlying economy—a valuation so high that it has never been witnessed before. A doubling of corporate debt to a record 45% of GDP isn’t a concern either—even when considering the quality of that debt is at a record low. And, having trillions of dollars worth of sovereing debt with a negative yield is just par for the course…or so they insist.

At least that is their public spin. However, the Fed recently found it necessary to telegraph to certain insiders within the Main Stream Financial Media what it would do during the next financial crisis. Here is the plan: It has pledged to act early and forcefully once the next crisis becomes manifest. The Fed will also publicly promise to do whatever it takes to fight deflation and tumbling asset prices and rising unemployment rates immediately—there will be no scaling into the next fight. Finally, our government will not delay or tinker around the edges when it comes to passing the next fiscal stimulus. It seems both parties have agreed that a massive tax cutting and infrastructure package would need to be enacted very quickly once the next recession arrives.

Of course, our government will have to recognize a crisis exists in the first place, which given the historical record, won’t be until the markets are in absolute free fall. But assuming they do eventually arrive on the scene, those are the things it would try to do “better”. This is crucial to understand if you want to make the most prudent investment decisions going forward. This is because the changes to economic growth and with the inflation/deflation dynamic are going to be unprecedented in scope and in magnitude. If investors are not modeling those changes they will be blindsided. Prepare now while you still have a chance!

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Reality Check Now in Progress

September 17th, 2018

The long-awaited dose of reality from the massive and unprecedented financialization of the global economy has finally begun.

Of course, those of us who understood from the start how healthy economies and markets naturally function, knew that a viable recovery from the fiscal and monetary excesses–which caused the great recession and financial crisis of 2008–was never underway. This is because central banks manipulated interest rates to zero percent and below and kept them at that level for a decade. Then, those same low rates engendered a humongous amount of new debt to be incurred, leading to the rebuilding of the current stock and real estate bubbles. And, it also created a tremendous and unprecedented bubble in the global fixed income market. This entire artificial construct, which was built upon bigger asset bubbles and greater debt loads, is now being tenuously held together by that very same government-engineered bond bubble.

However, the bond bubble is now bursting. Global central bankers now face the results of their $14 trillion worth of money printing since 2008, which was manufactured in search of fatuous inflation targets. This “successful” achievement of inflation goals is now being met with the removal of that liquidity, as asset price levels have become completely unstable.

Indeed, this switch to a hawkish monetary policy is now being adopted by many of the world’s central banks. There have been a total of 13 countries that have hiked interest rates so far this year, and only 5 rate cuts. According to Capital Economics, among the 20 major global central banks, they cover, just one (China) will cut rates in the remainder of this year. Whereas, the U.S., Canada, Norway, Sweden, Brazil, India, and South Korea are all expected to hike before year’s end.

Not only is the next rate decision expected to be Hawkish in 14 out of the 20 nations—with Japan expected to be neutral for the foreseeable future–but the pace of monthly Quantitative Easing is projected to drop to zero by the end of 2018, from $180 billion at its peak in March of last year. This incorporates the Fed’s selling $600 billion off its balance sheet per year starting in October.

These central banks are being forced into a tightening monetary policy due to rising consumer prices and asset bubbles that have become a major risk to economic stability. Otherwise, these countries risk intractable inflation and a destructive rise in long-term interest rates.

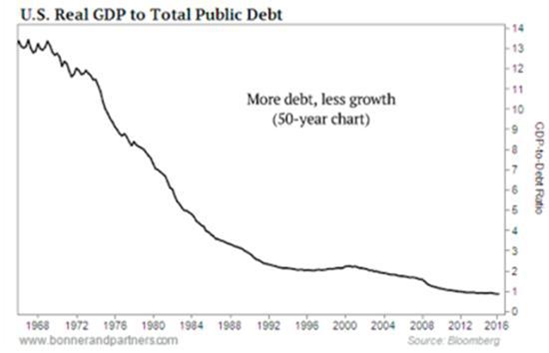

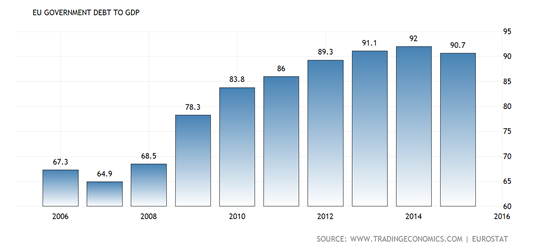

Leading to this potential chaos in fixed income is the massive spike in global debt levels. Thanks to the free-money policy from central banks, debt has increased by $70 trillion since 2007, to reach $250 trillion–an increase of over 40%! Not only has the nominal level of debt soared but the leverage ratio is up too. Today, the worldwide economy suffers a debt to GDP ratio of 320%; it was 270% leading up to the financial crisis.

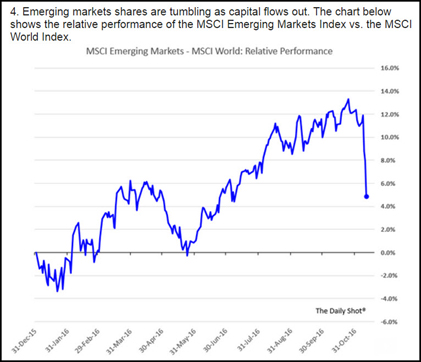

Nevertheless, the change in global monetary policies is already adversely affecting emerging markets (EM), commodity prices, and the real estate market here in the US.

The EM space is highly sensitive to interest changes in the U.S. because these countries have borrowed massively in dollars and rely on quiescence in currency exchange rates to be able to service their foreign debt. The prospect of EM defaults has sent these markets crashing 21% from their highs earlier this year

Leading the bear market in the EM space is the collapse of Chinese shares. The Shanghai Stock market has entered into a brutal bear market because the Sino-scam government has reached the end of its rope; and can no longer generate growth by issuing new debt. Chinese shares are down 19% YTD and have plunged 25% since the January high.

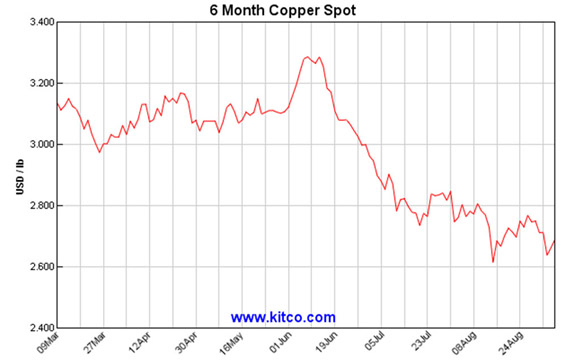

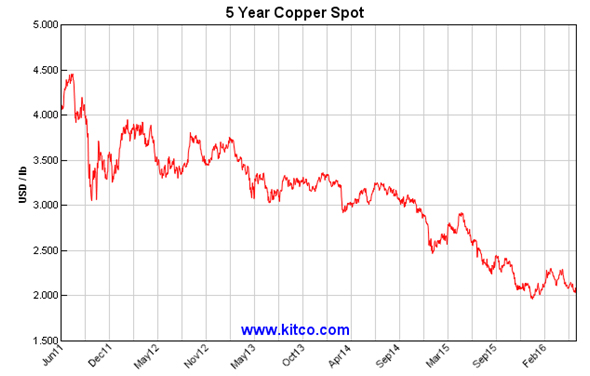

Dr. Copper, known as the commodity with a Ph.D. in economics because of its sensitivity to economic growth, has dropped 20% in the past three months as well.

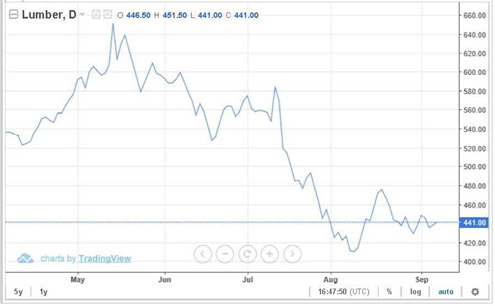

One has to also wonder about the validity of the globally synchronized recovery and strong consumer mantras coming from Wall Street shills; while the lumber price has tumbled 40% since its May high.

The Fed’s reverse QE program, along with its seven rate hikes from December 2015 thru June 2018—with two more slated for this year–is also putting pressure on the most interest rate sensitive parts of the U.S. economy. For example, the housing market is cooling. The largest part of the real estate market (Existing Home Sales) has dropped 4 months in a row and are down 1.5% year-on-year. In addition, Pending Home Sales have suffered losses 7 months in a row and slumped 2.3% YoY.

The truth is as long as the bond bubble kept inflating it was able to mask the huge imbalances built up in debt and asset values. However, we have finally reached the point, after a decade of this market-destructive experiment, where the bond bubble is bursting. Central banks will continue to tighten rates on the short-end of the yield curve until inflation is choked off, which will crush asset prices and GDP growth. Or, long-term interest rates are going to rise intractably if central banks were to now stop raising rates and let inflation run wild. In either case, the bond bubble is bursting and will continue to do so.

Printing money covers up a lot of problems in the short-term. But in the long-run, the process of massively diluting currencies in order to force down interest rates towards the zero percent level and below, greatly exacerbates the problems that governments were trying to ameliorate in the first place.

In other words, asset prices have become even more distorted, and debt levels have grown to a greater destabilized level than ever before. Inflation and debt can’t be the cure for a crisis caused by too much inflation and debt. But thankfully, this principle will no longer have to be explained; as the empirical evidence of the next financial crisis has already begun. We can only hope that in its aftermath, this lesson will finally be learned.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse.”

Turkey is Not Contained

August 20th, 2018

During my last appearance on CNBC, before I was banned several years ago, I warned that the removal of massive and unprecedented monetary stimuli from global central banks would have to be done in a coordinated fashion. Otherwise, there would be the very real risk of currency and debt crises around the world.

However, coordination among central banks is not what is happening. The Fed is miles ahead in its reversal of monetary stimulus, as it has already raised rates seven times; with two more 25bps rate hikes in the pipeline scheduled for later this year. It has also avowed to sell off two trillion dollars’ worth of debt off its balance sheet–while the rest of the world’s central banks are far behind in this monetary tightening course. This has led to a significant increase in the value of the US dollar.

The strengthening dollar is placing incredible stress on the EM space, especially those countries that hold onerous dollar-denominated debt in conjunction with large current account and budget deficits. This is reminiscent of the Asia Debt Crisis that took place in the late 1990’s, which took Wall Street for a wild ride as well.

From 1985 to 1996 Thailand’s economy grew at an average of over 9% per annum. Those envious growth rates attracted “hot” money from around the globe and helped send the Debt to GDP Ratio soaring. During Thailand’s golden years, inflation was at bay, and the Thai baht was pegged to the dollar at 25 to 1. Then in May of 1997, the baht was hit with massive speculative attacks–the market sensed the blood in the water. On July 2, 1997, currency and debt pressure forced Thailand to suddenly break the peg with the dollar and let the currency devalue. This currency turmoil resulted in substantial depletion of Thailand’s official foreign exchange reserves and marked the beginning of a deep financial crisis that spread across much of East Asia.

In turn, Malaysia, the Philippines, and Indonesia also allowed their currencies to weaken, and market turmoil affected stock markets in Hong Kong and South Korea.

By August the International Monetary Fund (IMF) came in with a $17 billion-dollar bail-out package; and then another bail-out of $3.9 billion was necessary soon afterward. Shortly after the Asia crisis subsided, the Russia crisis began; eventually leading to the infamous demise of the hedge fund Long Term Capital Management, and the ensuing Fed-orchestrated bail-out of Wall Street.

During that decade of Asian economic ebullience, the foreign currency debt to GDP ratio rose from 100 percent, to 180 percent at the peak of the crisis.

Turing to today, a decade’s worth of interest rate suppression in the developed world has sent global investors on a frenzied chase for yield like never before in the emerging markets. Excess liquidity has resulted in fiscal mismanagement, current account deficits, and large dollar-denominated debt loads. According to the Institute of International Finance, corporate debt in foreign currencies has soared to $5.5 trillion, the most ever on record.

EM economies were already under stress from the waning of China’s second massive credit impulse since 2007, which was designed to ensure the permanency of the Xi Jing Ping dynasty. Emperor Xi was enshrined by the results of the election in March of this year, but that didn’t fix China’s untenable debt position. Bloomberg recently reported that non-performing loans in had their biggest quarterly increase on record in Q2, up to nearly 2 trillion yuan. Communist China can no longer be the credit card to the developing world. Its own destabilizing and rapidly growing 300% debt to GDP ratio, according to the Institute of International Finance, has curbed its impulse to pave over eastern Europe and the rest of Asia, a.k.a. it’s “Belt and Road initiative.”

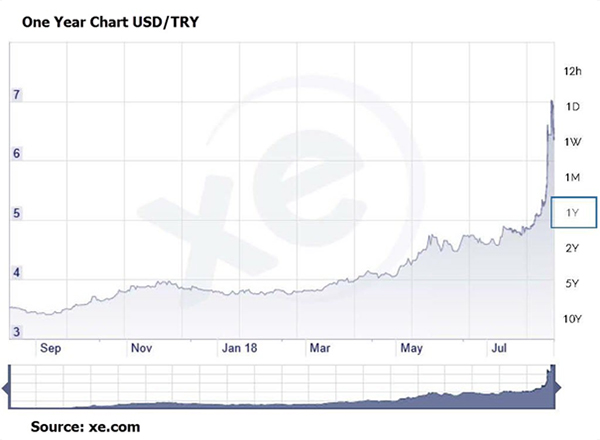

And this brings us to the latest EM debacle making news today. For years Turkey has been stimulating its economy through easy credit and budget deficits. Much like China, Turkey has piled on foreign denominated debt to fund government-sponsored projects that lack the productivity to curb the debt burden. This past Friday its currency dropped as much as 16% relative to the dollar, and the lira is now down 70% this year.

Turkey has one of the highest debt loads in all the EM space; owing some $450 billion to foreign creditors–$276 billion of which is denominated in dollars and euros.

Of course, Wall Street carnival barkers and central bankers are quick to assure us that the situation in Turkey is isolated and contained – just as they assured us the sub-prime debt crisis applied to a small number of troubled loans back in 2008.

It is true that Turkey only represents 1% of global GDP, and is not a systemically vital nation. Sadly, it is also true that Turkey is a paragon for 100% of the problems that exitst in emerging markets. Namely, intractable debt levels with an overreliance on dollar-based loans. Therefore, these teetering economies can become completely destabilized if any one of the following three conditions occurs: A significant fall in the domestic currency against the dollar; a protracted interest rate spike; or a slowdown in GDP growth. Any combination of the three can lead a nation to insolvency.

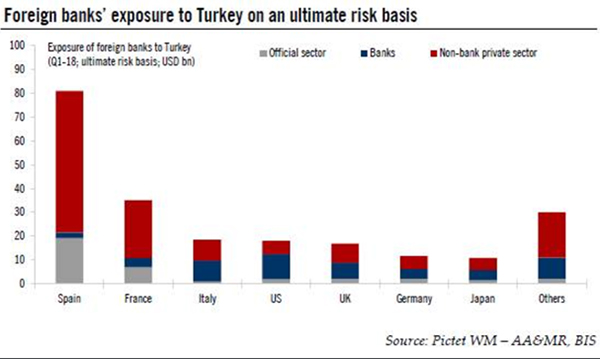

As an example of how the situation in EM’s is not contained look at the effect on the European Banking System. Some banks on the hook for this Turkey’s debt include: BBVA (BBVA.MC) of Spain, UniCredit (CRDI.MI) of Italy and BNP Paribas (BNPP.PA) of France, and their shares have been plummeting due to this notable debt exposure – let alone the emerging market space in its entirety.

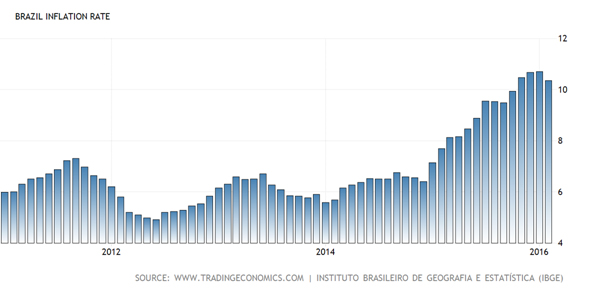

With economies around the globe such as Venezuela, Iran, Brazil, Argentina, Mexico, Indonesia, Russia, and South Africa in various stages of turmoil, it is prudent to say that we are likely embarking upon an EM debt crisis comparable to Thailand in 1997 and Russia in 1998; in which both countries closed their capital accounts after attracting billions of dollars in foreign loans. These defaults hastened one of the most severe liquidity crises in world history.

The world economies are caught in the crosshairs of an unprecedented tightening in monetary conditions, including the never before attempted liquidation of trillions of dollars’ worth of bonds from the Fed’s balance sheet. The developed worlds central banks are moving to a hawkish monetary policy stance—although not at the same pace–at the same time many EM central banks have been forced to jack up interest rates to defend their currencies. For example, the Argentine central bank just lifted its base lending rate to 45%.

Perma-bulls would have you believe that the problems of Turkey are all about the persecution of pastor Andrew Brunson; who God willing will be released from his imprisonment soon. But his release would not stem the tide of the rising dollar, which is up 9% in the last four months. Nor, would it ameliorate the over-leveraged condition of sovereign nations. Most importantly, it would not rectify a decade worth of interest rate suppression that has engendered the biggest bond bubble in history. In this regard, sadly, much of the distortions in Emerging Markets are also shared throughout the developed world.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Anatomy of Hyperinflation

August 13th, 2018

Two drones filled with explosives were recently deployed in a failed assassination attempt to take out Venezuelan President Nicolas Maduro. Chaos filled the streets as the military ran for their lives. But this sort of pandemonium is commonplace in Venezuela today: Where citizens have run out of basic necessities such as toilet paper and have begun eating their pets in order to stay alive. The mainstream Keynesian-brainwashed media doesn’t talk much about Venezuela or hyperinflation; perhaps because they are viscerally aware that the seeds of intractable inflation on a worldwide basis have already been sown by the global elites–and they don’t want to frighten you.

Venezuela is currently in the throes of hyperinflation on a massive scale. The communist-led government has mismanaged its economy into a fiscal catastrophe. Among other things, skilled farmers were thrown off their land and replaced by government apparatchiks that are untrained and incapable of producing enough food to feed the people. Oil production also waned due to mismanagement and corruption. To smooth over the government’s mounting debt it printed massive amounts of money in response to rising budget deficits. The currency plummeted, and foreign denominated debts were defaulted on.

The International Monetary Fund is forecasting a 2,349% inflation rate for Venezuela this year. The Venezuelan people are starving and leaving the country in droves—the nation is a modern-day cautionary tale of what happens when fiat money dies.

And while Venezuela is the poster child of failing economies, there are other deteriorating economies around the globe that are not far behind. Turkey is another economy on the brink of a hyperinflationary death spiral.

Turkey’s lira has weakened over 40% against the dollar this year and is now near all-time lows. This is leaving Turkey in a no-way-out position as it attempts to repay debt denominated in non-domestic currencies like the dollar and the euro. Turkish banks and corporations have billions of dollars’ worth of foreign-currency debt coming due that they will find nearly impossible to service with the Turkish lira in freefall.

In addition to corporate debt, Turkey’s government depends heavily on short-term “hot money” to fund its current account deficit. This deficit has widened in recent years as President Erdogan, in a desperate bid to stay in power, garnered favor with stimulus measures including interest rate cuts, loan guarantees, infrastructure spending and tax breaks after the failed 2016 coup. And now we have US sanctions, which if fully enacted will ensure the Turkish economy’s baneful fate.

Perhaps even worse off than Turkey, we have Iran, whose economy is feeling the bite of US sanctions and is also in freefall. Iran’s currency, the rial, has lost more than 80% of its value in the past 12 months. In addition to the US sanctions, Iran is also plagued with government profligacy and corruption. This economic chaos has also given way to social unrest. Like Venezuela, Iran is another country rich in oil; but has a government that hates free markets.

And another country worth watching now is South Africa; a country standing at the crossroads of economic stagnation and collapse. Like Zimbabwe in 2000, the government of South Africa is in the process of redistributing farmland from white landowners to black South Africans. Add to this tax hikes, record gasoline prices, stubbornly high unemployment; you have an economy that is showing signs of cracking.

Hyperinflations all share a similar pattern. They have four basics components in common: one, is a debt to GDP ratio that rises to the point that the market deems the nation to be insolvent; two, interest rates begin to spike out of control, which greatly increases the nation’s debt to GDP ratio; three, the central bank is forced to monetize all debt issuance in a vain attempt to cap the interest rate death spiral, and fourth, the end result is a complete currency collapse that occurs both internally and externally.

For Zimbabwe, the end result was the 2nd worst hyperinflation in the world’s history—the one in Hungary following WWII takes first prize. It is estimated that the inflation rate in Zimbabwe peaked at about 80 billion percent year-on-year in 2009.

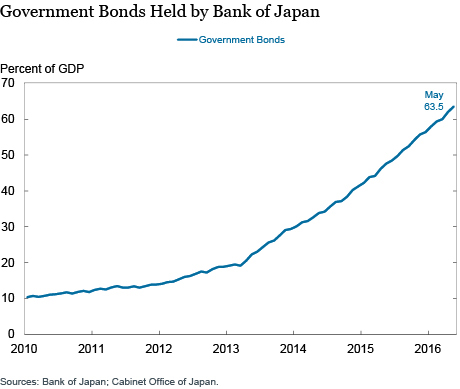

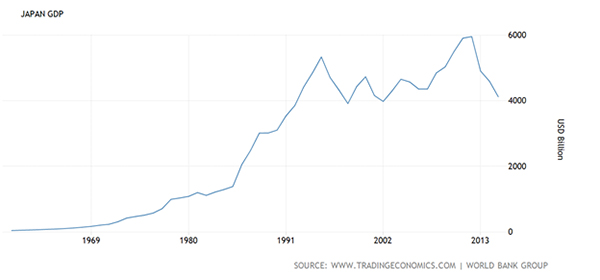

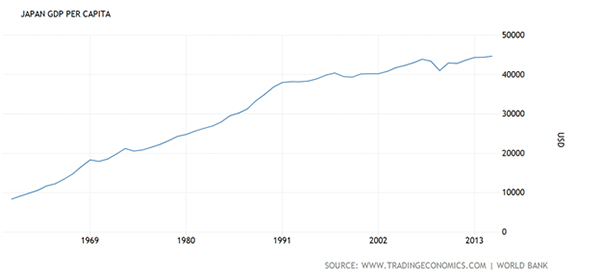

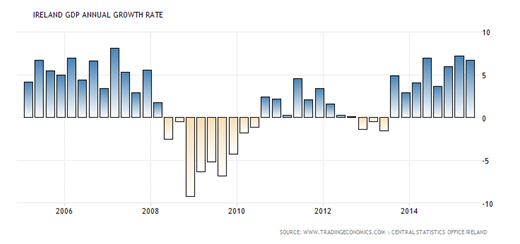

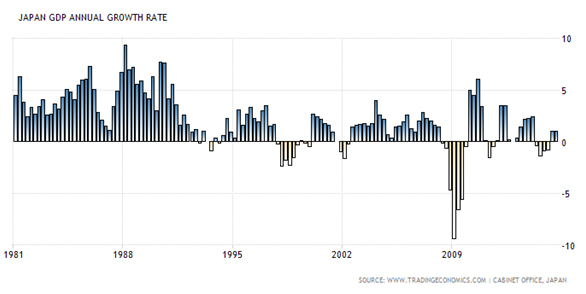

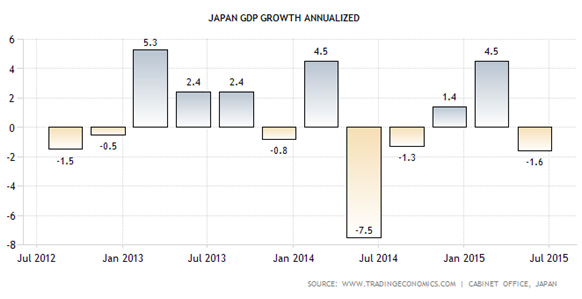

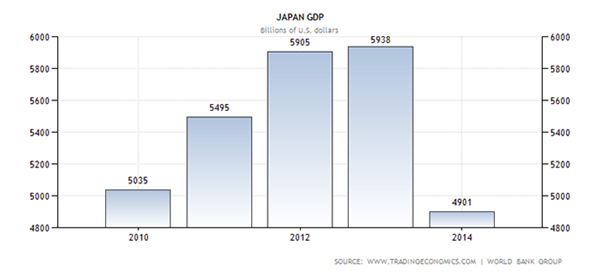

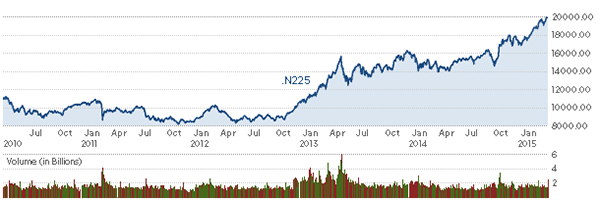

That brings us to Japan. Japan is the fourth largest economy in the world using purchasing power parity, and one wouldn’t automatically place it with the likes of Venezuela, Turkey, or Iran. But the truth is Japan is mired in multiple lost decades of economic stagnation. Their central bank now owns 85% of JGB’s and Japan is an insolvent nation with a quadrillion yen in debt. The Bank of Japan (BOJ) has now gone all in with this debt and has promised to make sure that interest rates never rise. In fact, the rate was pushed to zero percent even going out to ten years.

Recently, the BOJ engaged in a brief experiment with its interest rate policy. Rates on the long end of the yield curve were allowed to rise just a few basis points in an effort to help out its banking system. The mere hint of this caused bond yields to immediately jump from 5 basis point, to over 10 basis points, which is over 100% due to the law of low numbers. This caused a panic in global markets and pushed the Nikkei Dow down 300 points in just one day.

This led Japan’s courageous leaders to, in that same one day, completely reverse course from their “experiment” with free markets. The Japanese government and central bank have now admitted that interest rates can never be based on market values and they will print money to infinity to make sure zero percent interest rates are a perpetual reality. Allowing the Ten-year Note to stray far away from offering investors zero yield would quickly collapse the stock market and the economy.

Once a government admits that it needs to continually print money in order to pay back its debts, the currency begins to become virtually worthless and the journey down runaway nflation has begun.

However, hyperinflation has not yet happened in Japan; not even its lesser cousin intractable inflation has occurred. In fact, the Japanese CPI can’t seem to reach one percent. This is because unlike hyperinflations of the past, Japan is a major global economy and therefore has a reserve currency. And, the nation suffers from decades of deflation. That mindset of perpetually falling prices has been brutally inculcated into consumers. Hence, the third ingredient to create hyperinflation—a complete currency collapse—is much more difficult to produce in Japan.

It is simply much easier for a small banana republic to have both an external and internal currency crisis than it is for substantial global power that enjoys a reserve currency status.

Furthermore, at this juncture the Japanese yen isn’t that much different than the rest of developed world’s currencies; in that they all have interest rates far below historical averages and their central banks have massive balance sheets that have yet to be unwound.

The amoebae with the highest IQ on this front is the United States. The Fed is draining its balance sheet—albeit from very high levels–and the yen is falling against the dollar. Still, an all-out collapse of the yen, with its typical millions or billions annual inflation rate, is probably not in store. However, that doesn’t mean Japan is completely out of the inflation woods.

A brief look back in history will show that the Roman Empire was at least partially destroyed by intractable inflation (inflation rates in the thousands of percent per annum). Inflation did not go hyper because a complete external currency collapse was improbable given that there was not a sophisticated real-time currency trading market in place with foreign nations. And yet, there was still a destabilizing breakout of inflation internally. This is because the government was systematically attenuating the percentage of gold, silver and brass in its coins.

The point is that we should soon see rapid inflation globally the likes of which we have not seen since the Roman Empire circa 275AD. This is because the governments of the developed world, including Europe, Japan and the US, will soon have to admit that their future solvency depends upon interest rates that can never normalize and debts that will be forever monetized. In other words, expect an internal inflation crisis to wipe out much of the purchasing power of all fiat currencies due to global central banks’ response to the imminent bursting of the current global financial bubble.

Inflation occurs when a currency is diluted to the point when the market loses confidence in its purchasing power. Unfortunately for the world’s middle classes, that is exactly where we are headed in the wake of the next global financial crisis.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Trump Declares War on the Fed

July 31st, 2018

It appears when it comes to fighting the old Washington establishment—comprised of the deep state and the Federal Reserve–Mr. Trump is getting sucked into the vortex of the D.C. swamp rather than draining it. The hope was for our “Disrupter in Chief” to be more concerned about our children’s future than his own; and for his focus to span beyond the next election cycle. Instead of allowing consumers to finally receive a real return on their savings; and to let asset bubbles seek a level that can be supported by the free market, Trump has chosen to breach a boundary that has been essential to providing hope for the future solvency of our nation.

The independence of a central bank is paramount in maintaining a wall that helps prevent the unfettered monetization of fiscal profligacy from the Executive and Legislative branches. But Trump is taking whacks with a sledgehammer at this wall with his public admonishment of his own Fed appointment Jerome Powell. This is something I predicted back in March of this year when I wrote: “Trump to Declare War on the Fed.”

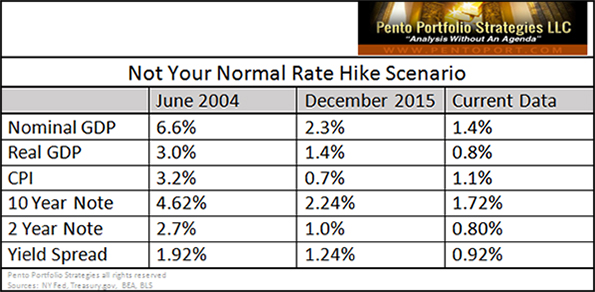

Let’s put a little history behind this watershed and destabilizing change now underway. On December 17th, 2015, citing confidence in the economy, the Fed raised its key interest rate by 0.25%. And, in an attempt to make the Fed Funds Rate “great again,” the Fed has raised this rate six more times since then, bringing it to 2%. And now, Chair Powell has assured markets that two more hikes are in the pipeline for later this year.

It’s clear these past and future hikes are weighing heavily on the President’s mind. In a recent interview on Squawk Box with CNBC’s Joe Kernan, Trump characterized his Fed appointee as a “very good man,” even though he was “not happy about his interest rate policy”.

To his credit, Powell is working off the belief that the economy is now finally strong enough to normalize rates from their historically-low levels. However, Trump is concerned that the strong dollar will put the U.S. at a disadvantage because the Fed’s counterparts, such as the European Central Bank and the Bank of Japan, are still maintaining ultra-loose monetary policies. Not only this, but our President is an avowed lover of debt and viscerally understands that significantly raising debt service costs on the record $21.2 trillion U.S. National Debt, which is projected to grow by over $1 trillion as far as the eye can see, will greatly retard GDP growth.

The president acknowledged that he shouldn’t be running interference on the Fed’s perceived independence–but he doesn’t care at all about the perception. He recently explained:

“Now I’m just saying the same thing that I would have said as a private citizen…So somebody would say, ‘oh, maybe you shouldn’t say that as president.’ I couldn’t care less what they say, because my views haven’t changed. I don’t like all of this work that we’re putting into the economy, and then I see rates going up.”

But, private citizen Trump had a completely different opinion on the Fed’s monetary policies. In fact, Trump had publicly criticized the Fed for years, lambasting its decision to keep interest rates low and prop-up the economy in the years following the Great Recession.

In 2011 Trump tweeted: “The Fed’s reckless monetary policies will cause problems in the years to come,” “The Fed has to be reined in, or we will soon be Greece,” In 2012 he noted: “The Audacity of @BarackObama – the Federal Reserve purchased 61% of all debt issued by Treasury in 2011. Killing our children’s future.”

Going further he once suggested to CNBC that Yellen should be “ashamed”…”She is obviously doing political, and she’s doing what Obama wants her to do.” His hypocrsy on this matter is stark.

In my March commentary I opined…”look for an epoch battle between our independent central bank and the Executive Office. We have a President who both viscerally understands the power of low rates and doesn’t follow implied government protocol…As the equity market continues this volatile cycle and interest rates rise unabated, expect Donald Trump to start a tweeting campaign demanding the return of QE and calling for the Fed to put a cap on interest rates.”

Trump would love to have an obsequious Fed Chair. However, right now Powell is firmly on path for another two hikes this year. And because of the President’s very public call-out, he is going to want to continue the ostensible appearance of Central Bank independence for as long as possible. That is…at least until the stock market falls apart.

Since the autonomy of the Fed has been publicly impugned, Powell has no other option but to continue on this path of raising rates. Therefore, expect the bully pulpit and twitter war to intensify greatly as the economy and stock market succumb to; continued tightening from the Fed and the sharp reduction of its balance sheet, the exiting from QE by the ECB and reduction in asset purchases by other major central banks, an escalating trade war, an inverted yield curve by year’s end, a rising dollar, EM and China distress, unsustainably-massive debt levels and the fallout from the bursting of the worldwide bond bubble.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Tariffs “Trump” Tax Cuts

July 13th, 2018

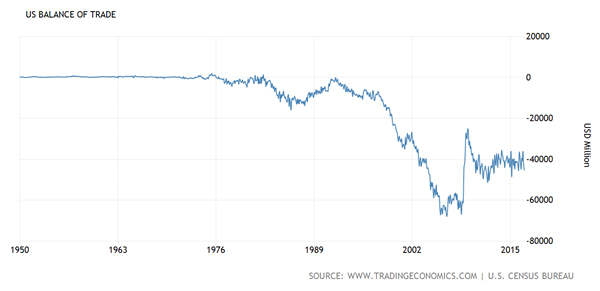

China appears to have more to lose from a trade war with the US simply because the math behind surpluses and deficits renders the Bubble Blowers in Beijing at a big disadvantage. When you get right down to the nuclear option in a trade war, Trump could impose tariffs on all of the $505 billion worth of Chinese exported goods, while Premier Xi can only impose a duty on $129 billion worth of US exported goods–judging by the announcement on July 10thh of additional tariffs on $200 billion more of China’s exports to the US we are well underway towards that end. However, this doesn’t mean China completely runs out of ammunition to fight the battle once it hits that limit.

The Chinese could seek to significantly devalue the yuan once again, as the nation did starting in the summer of 2015. Indeed, it could be exactly what they are doing right now.

This would partially offset the effect from the tariffs placed on its exports. However, it would also increase the debt burden on Chinese, and other Emerging Market (EM) dollar-based loans, which total over $11 trillion in. If EM countries that conduct trade with China allowed their currencies to appreciate greatly against the yuan, their exports would become uncompetitive. Therefore, in order to maintain a healthy trade balance with China, these nations would have to devalue their currencies alongside the yuan; causing a contagion effect. The last time China devalued the yuan was in 2015 and it caused chaos in global currency and equity markets.

China could also dump $1.2 trillion worth of its US Treasury holdings. The timing for this would hurt the US particularly hard because deficits are already projected to be over $1 trillion in fiscal 2019 that begins in October. When you add to this the Fed’s reverse Quantitative Easing (QE) plan of selling $600 billion worth of Mortgage Backed Securities (MBS) and Treasures, you get a condition that could completely overwhelm the private sector’s demand for this debt. Of course, a trade war with China also means there will be less of a trade surplus to recycle back into US markets. And if the incipient trade war leads to a recession in the US, deficits would soar much further than the already daunting $1 trillion level.

When you combine the baseline fiscal 2019 deficit of $1 trillion and $600 billion worth of Quantitative Tightening (QT) with a potential Chinese dumping of $1.2 trillion worth of Treasury reserves, and hundreds of billions of increased deficits arising from the reduced revenue from a slowdown in global commerice, the potential total deluge of debt that needs to be absorbed by the public in the next fiscal year could approach $4 trillion dollars!

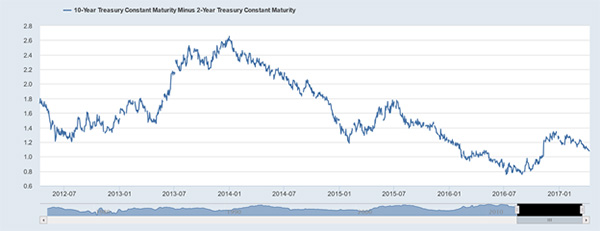

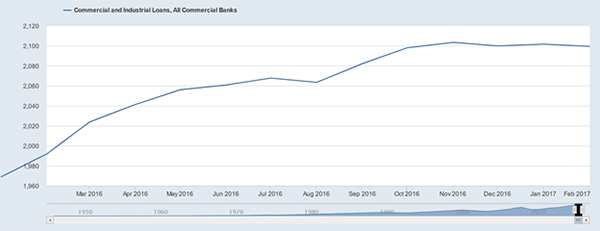

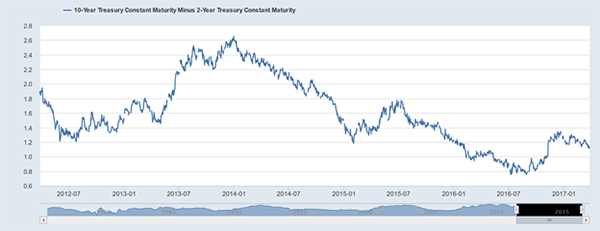

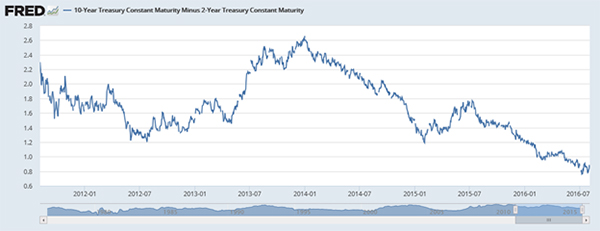

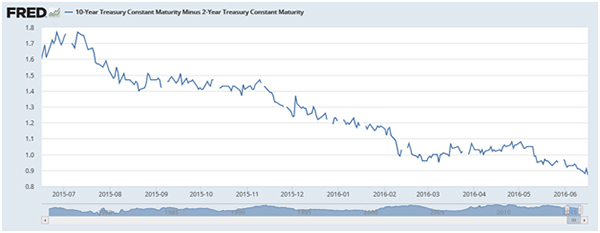

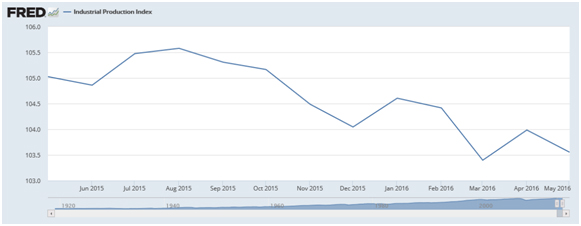

If you’re looking for the pony behind that dung pile you could say that the yield curve perhaps would not invert in this scenario as quickly as it is now—maybe—but the spread between the 2-10 Year Note has collapsed from 265 (basis points) bps in 2014 to just 27 bps today. Hence, the next 25bp rate hike from the Fed in September could be enough to flatten out the curve completely. Nevertheless, the resulting yield shock would be much worse than your typical inversion because runaway long-term bond yields are the last thing this massively overvalued equity market, which sits on top of record debt levels, can endure.

In other words, this upcoming tsunami of debt issuance would equate to a giant black hole that would suck all available investment capital from the private sector and send it towards the wasteful arms of government—the opposite effect of a tax cut. This would virtually guarantee a sharp slowdown in productivity and GDP growth. In truth, a productivity slowdown is something the US economy cannot afford at this time because Non-farm Productivity increased by a paltry 0.4% annual rate in Q1.

Since GDP is the sum of labor force + productivity growth, a further slowdown in productivity from here would be extremely recessionary, especially given the slowdown in US immigration and fecundity rates.

The major takeaway here is that China has more bullets in the chamber other than just putting a tariff on all US exports. And even though China has more to lose on face value, an all-out trade war is an extremely negative sum game for all parties involved. The resulting global recession, which is already approaching due to the impending complete removal of central banks’ bid for inflated asset prices on a net basis, is becoming expedited and exacerbated by the Trade war.

Debt-fueled Tax cuts have greatly boosted earnings growth on a one-time basis. And this has been completely priced in by the Wall Street carnival barkers. However, the global trade war and the bursting of the bond bubble–with its effect on record debt and asset prices–should more than offset the benefit from tax cuts in the coming quarters. The next recession/depression is approaching quickly and will finally cause the greatest financial bubble in history to unwind in spectacular fashion.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Is this the Most Hawkish Fed Ever?

July 2nd, 2018

My research shows that this is one of the most hawkish Fed rate-hiking regimes ever. It has raised rates seven times during this current cycle and is on pace to raise the Fed Funds Rate(FFR) four times this year and three times in 2019.

But what makes its monetary policy extraordinarily restrictive is that for the first time in history the Fed is also selling $40 billion per month of Mortgage Backed Securities (MBS) and Treasuries starting in Q3 and $600 billion per year come October. Because the Fed is destroying money at a record pace while the rest of the world’s major central banks are still engaged in money printing (QE) and zero interest rate policies (ZIRP), Jerome Powell’s trenchant and unilateral tightening policy is now causing chaos in emerging markets.

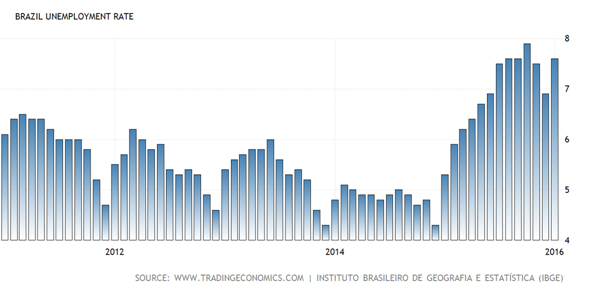

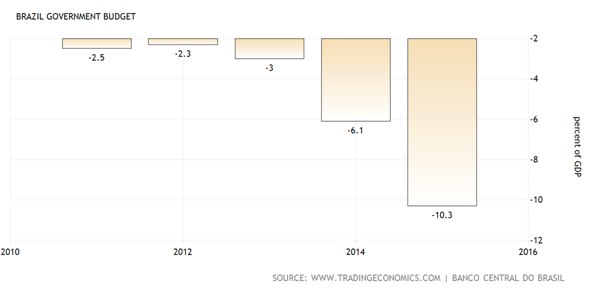

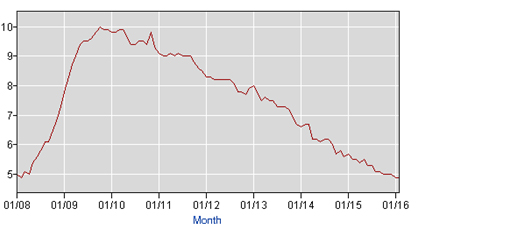

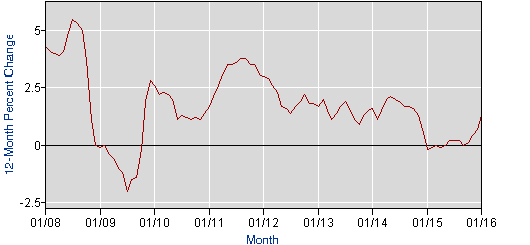

Many global equity markets have recently entered into correction mode or are in a bear market. The stock market in Poland is down 15% since January. Brazil is down 21% since February. China’s Shanghai Exchange is down 20% YTD and was down another 1.5% just last night. The Philippines market is down 23% YTD, Italian stocks are down 10% since May, and Argentinian stocks have plunged 33% YTD in dollar terms. In fact, 22 of the world’s biggest and most systemically important banks are also now in a bear market. The truth is currencies are crashing against the Dollar all around the globe. This sort of turmoil can be found in bond markets as well. For example, the Italian Two-Year Note yield surged from -0.36% in January, to 2.7% in May, before falling back to around one percent by the end of June.

The Institute of International Finance calculates that total Emerging Market (EM) debt skyrocketed to $63.4 trillion last year from $21 trillion in 2007 — I guess this is just one of those unintended consequences arising from global central banks offering free money for a decade.

The ugliest part of this picture is the amount of dollar-denominated debt from countries and corporations outside of the U.S. is over $11 trillion, according to the Band for International Settlements. Therefore, the mostly unilateral unwinding of QE and ZIRP from the Fed is causing upward pressure on the value of the dollar and thus vastly increasing the debt burden on foreign borrowers.

Although the growth and interest rate differentials between the U.S. and the rest of the world are causing distress in EM’s, China, and Europe, that doesn’t mean our markets are flourishing. In fact, the Dow Jones Industrial Average is down YTD, and 20% of the S&P 500 is in a bear market. But still, EM markets are where the salient problems can be found. For example, the Argentine peso has crashed 75% year-over-year against the dollar.

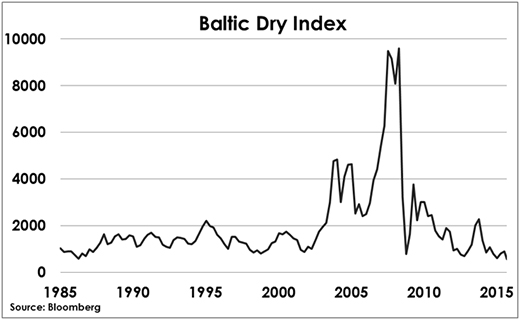

A funny thing happened on the way to Wall Street’s synchronized global growth narrative: According to capital economics, growth rates of air freight traffic and sea container volumes have hit their lowest levels in 18 months. Trade wars and central bank tightening are pulling down the spread between the U.S. Two and Ten-year Note yield, which is now just around 30 basis points (bps), down from 265 bps in 2014. That means we are now less than two more rate hikes away from inversion and the start of the official recession countdown.

According to the Fed’s dot plot, the probability of an inverted yield curve occurring by year’s end is extremely high. History proves that a recession follows an inversion by 6-24 months. However, not only does the stock market top out ahead of an official recession, as declared by the National Bureau of Economic Research; but since the economy is already much weaker than in past inversion points and debt levels and asset prices are much greater, it is certain that the recession and equity market collapse will occur much closer to the inversion than the previous occasions.

The Fed will most likely stop raising rates after the yield curve inverts. Therefore, we only have two more hikes ahead of us, which should occur about the same time the U.S. stock market and the economy really begin a precipitous decline. This will be very good news for those who are awaiting the return of a gold bull market, and in my view, that is just two quarters away.

Of course, the truncation of the Fed’s tightening cycle will not be enough to turn around global growth; especially in light of the fact that the reverse QE program will still be on autopilot. It should take a decline of at least 20-25% before Mr. Powell stops reducing the balance sheet. Nevertheless, given the level of debt and asset price distortions extant today, it will take much more than just a neutral Fed to stop the avalanche of deflation.

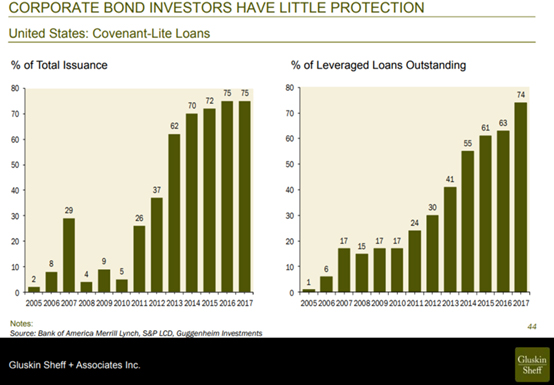

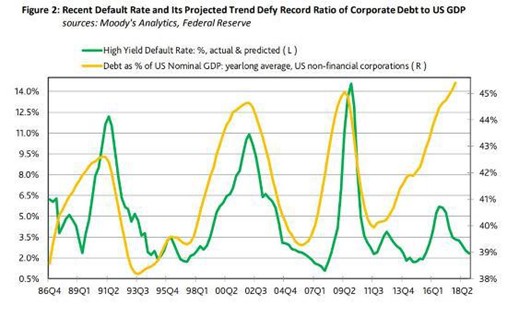

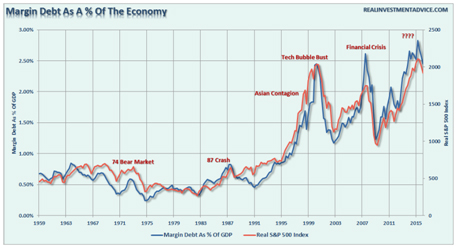

Corporate debt as a percentage of GDP is at an all-time record high. And, at the same time, the quality of this debt is at an all-time low. About 60% of the U.S. companies that Moody’s rates have a credit rating of speculative or junk, according to John Lonski, their Chief Economist. The amount of bonds in the Baa category (just above junk) rose 10.5% on average per year since 2009, to reach a total $2.69 trillion. The bottom line is that a collapse in High-Yield Bonds, Leveraged Loans and CLOs, which are nearly twice the total found prior to the Great Recession, will most likely be the nucleus of the next financial crisis that is now at our doorstep.

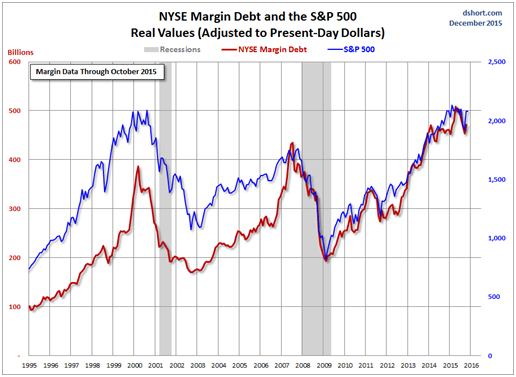

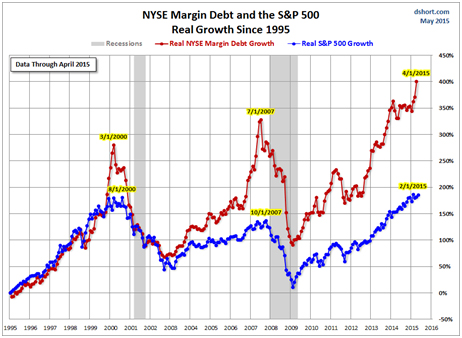

There is a record amount of margin debt—and debt of all forms for that matter–which now sits on top of record asset prices. And when you throw in EM distress from an aggressive Fed monetary destruction cycle and rate hiking campaign, and a Smoot Hawley trade war part II into this mix, investors are facing the most dangerous stock market ever. Embracing a “Buy and Hold” strategy in this environment is a death warrant for your portfolio; you must have an actively managed process to emerge ahead of the incipient financial crisis.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Global Bond Market Warns of Recession

June 27th, 2018

The global central bank counterfeiting spree that began in 2008, which took balance sheets from $3t to $15t, has finally created the inflation that has been so eagerly sought. But of course, all this money printing has not produced viable or robust growth. Rising rates on top of the gargantuan increase in global debt since the Great Recession is going to become a nuclear explosion: Since 2008, Household debt jumped from $35t-$45t, corporate debt skyrocketed from $43t-$70t and Government debt soared from $35t- $64t.

When you add to this mix the likelihood of a global trade war, you can understand why you must have an investment model that gets the timing correct for when these asset bubbles will burst. There’s a big lost opportunity cost from getting out too early but staying in too late will lead to penury. In regard to this dynamic, what I find most interesting is that long-term bond yields have stopped going up despite the environment that should be sending these yields soaring. Let’s go through some facts: Nominal Q2 GDP is growing around 6%, we now have $1 trillion deficits, and the U.S. government had a $147 billion budget deficit in May alone, which was an increase of 66% from the same month last year. Foreign central banks are dumping Treasuries and we have Headline inflation close to 3%. With these numbers how is it possible that the 30 year Treasury bond would only yield 3% and is causing the spread between the 2 and 10–year Note to shrink to just 0.34%?

Low rates in Germany and Japan can only partially explain such a huge gap between where long-term rates are and where they should be using historical context. All things being equal, the US 10-year Note should be at least 6%. The primary reason for low interest rates is that the global economy is debt disabled and that the removal of central bank stimulus on a global scale will very soon snuff out all inflation and growth and render the world into a synchronized recession/depression. As a primary example of how the reversal of ZIRP and NIRP is eroding growth can be found in the most critical part of the economy; the real estate sector. Mortgage purchase applications are down yoy and the applications to refinance a home have plunged to down 34% yoy. The end of the near 30-year trend of lowering your mortgage payment and using that money to boost consumption is now over. And the soon-to-be plunge in home prices should virtually eliminate Mortgage Equity withdrawals completely.

And yet, the Fed still has penciled in 5 more hikes between now and the end of next year, plus the selling of $50 billion dollars’ worth of bonds from its QT program each and every month starting this October. However, they will never get to consummate on either of these plans because the wheels will come of the global economy well before then. Just imagine what will happen to EM debt and those economies—that are already falling apart–if the Fed were to actually reach 3.25% on the FFR and sell nearly a trillion dollars’ worth of MBS and Treasuries?

Therefore, it is so very crucial to have a plan, process and model that has been rigorously back tested and based on true economic principles. Otherwise, it won’t work and you’ll be looking at lagging economic data and applying it to broken models just like the Fed does. Given today’s unique and perilous environment, that’s a recipe for disaster.

Michael Pento is the President and Founder of Pento Portfolio Strategies, produces the weekly podcast called, “The Mid-week Reality Check”, is Host of The Pentonomics Program and Author of the book “The Coming Bond Market Collapse”.

Catalyst for the Next Financial Crisis

June 4th, 2018

The cause of the Great Recession circa 2008 was collapsing home prices that led to an insolvent banking system. However, the next economic crisis will result from the bursting of the worldwide bond bubble and its devastating effect on asset prices.

One of the dangers from spiking borrowing costs is the shutting out of distressed corporations from capital markets, which will inhibit their ability to roll over and service existing debt. This will lead to a massive increase in the number of insolvent corporations.

We are already beginning to see the fallout from this phenomenon. According to the American Bankruptcy Institute, Chapter 11 bankruptcies spiked 63% year-over-year in March to 770 filings. This is the highest number of filings for any month since April 2011. And, according to Moody’s, defaults in the retail sector reached an all-time high in the first quarter of this year. Even worse, those Bankruptcy filings in March were the second largest year-over-year jump for any month since the Great Recession and is indicative of an economy that has reached the end of its credit cycle.